Debt settlement or consolidation may be an option if you have trouble paying your bills. Although each method can help you get out debt, they each have their pros and cons. You will need to assess your situation before deciding which method is best for you.

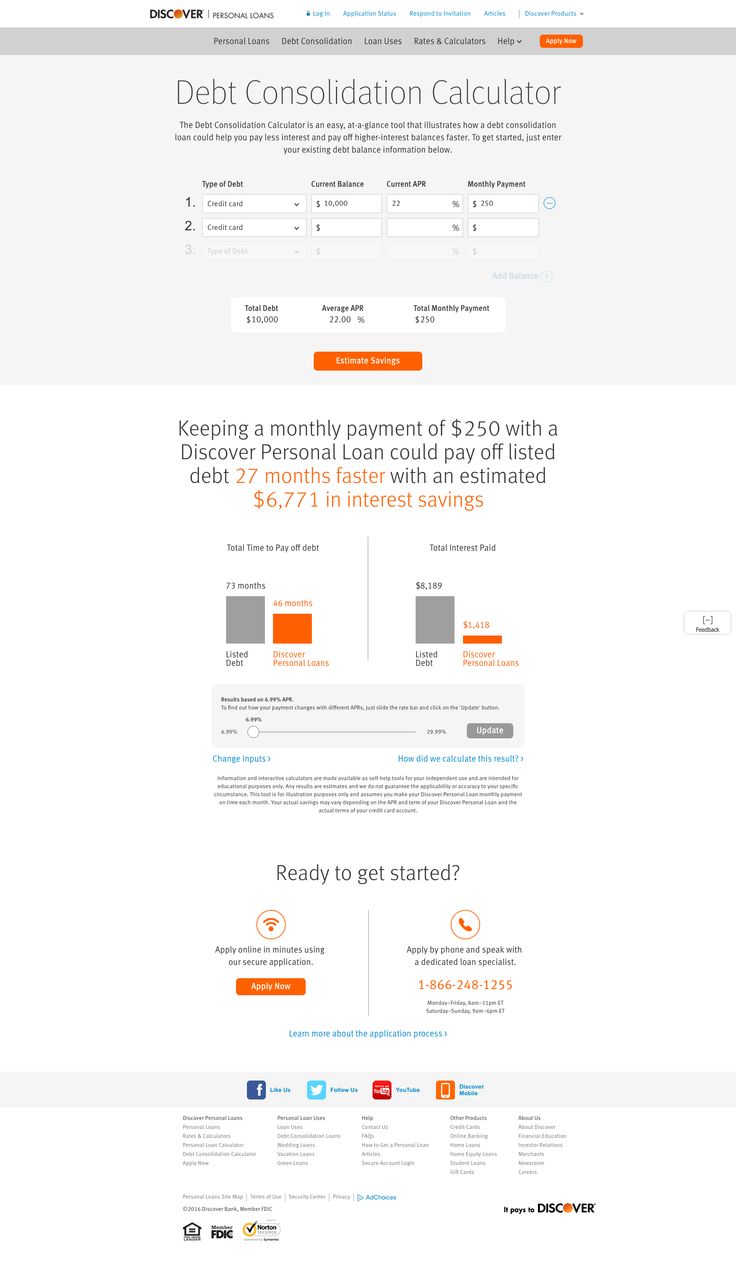

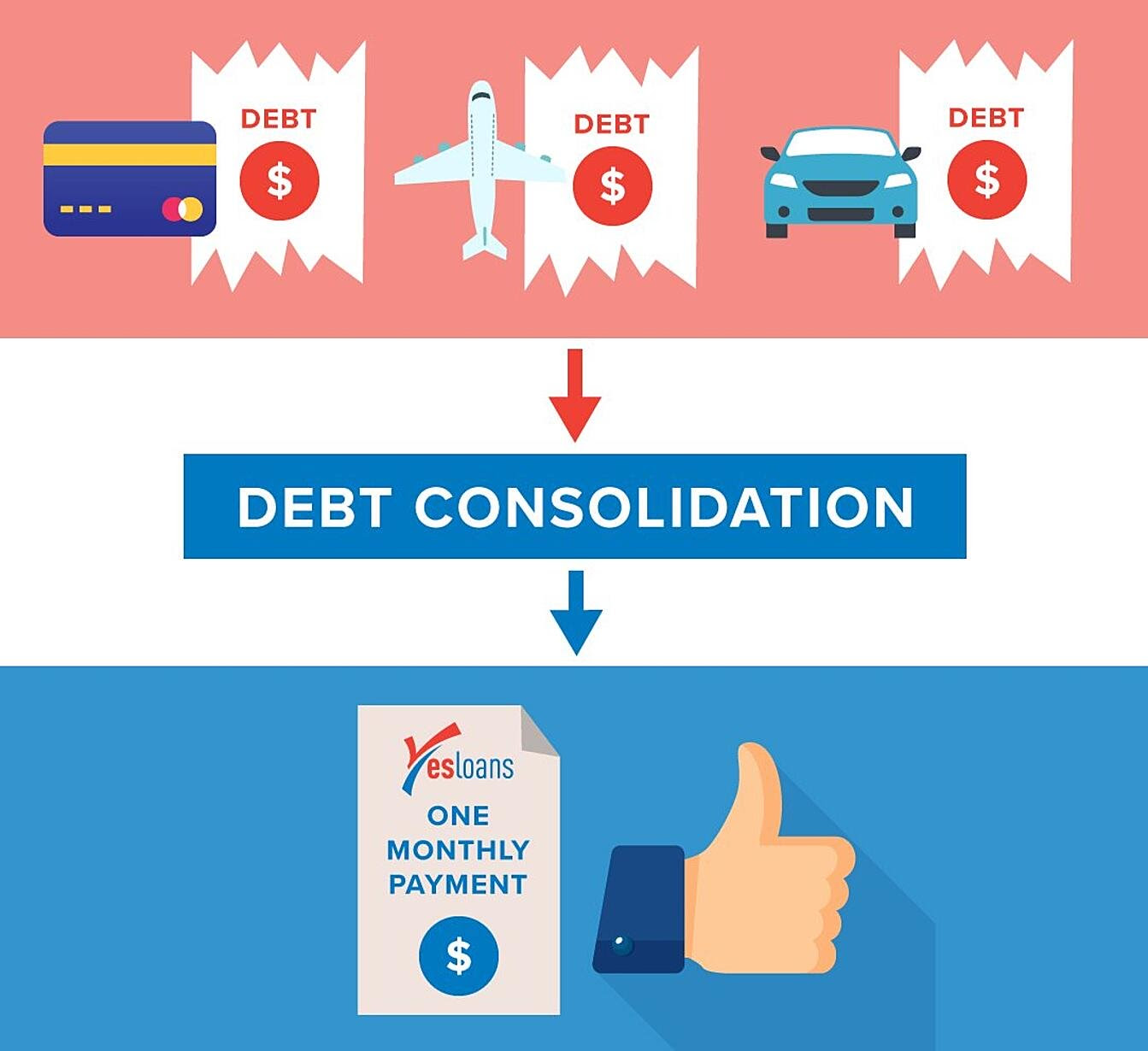

Debt consolidation is a way to combine several unsecured debts into one loan with a lower interest rate. Consolidating your finances can simplify your life. However, you will need a strong credit rating and income to qualify. The service may be offered by a reputable debt consolidation company.

Negotiating a reduced payment with creditors is one form of debt settlement. You may be able to pay one lump sum or multiple payments that can be spread over time. Most cases, the total amount you pay will be lower than what you owe. Settlement can be used in many cases, including for medical bills and credit cards.

If you have difficulty making your monthly payments, debt consolidation may be an effective option. This will reduce interest rates and fees as well as eliminate multiple monthly payment. You'll still need to pay regular monthly payments but will receive a single payment at a lower interest rate.

Debt consolidation has two major disadvantages: higher interest rates, and a negative effect on your credit score. Often, this can stay on your credit report for up to seven years. Consolidating loans should be used only if you can afford them and if your income supports the new loan.

If you're considering a debt management plan, you'll need to contact a consumer credit counseling agency. These agencies can help adjust your budget to create a monthly repayment that suits your lifestyle. Lowering your monthly payments will help you stop using your credit card and can prevent you from getting into additional debt.

While debt settlement can seem risky, it may be a good option to help pay off your debts. The debt settlement company will work with you to reduce your interest rates and make your debts payable for less than what you owe.

Debt consolidation will not reduce your overall debt. Even if you consolidate your debts, you may still owe more than you can pay back. Also, a consolidation loan's interest rates can be higher than your existing loans.

People who are unable to pay their bills on-time, have difficulty paying their debts or are at risk of bankruptcy can use debt settlement. But it can be risky, and you should only use it if you have no other options available.

Both approaches to debt relief are viable options. However, it is important that you consider your financial situation and make a decision about which method you prefer. A debt consolidation company can provide free debt counseling and educational tools to help you understand the process.

FAQ

How do wealthy people earn passive income through investing?

There are two options for making money online. One way is to produce great products (or services) for which people love and pay. This is what we call "earning money".

A second option is to find a way of providing value to others without creating products. This is what we call "passive" or passive income.

Let's imagine you own an App Company. Your job is development apps. But instead of selling the apps to users directly, you decide that they should be given away for free. That's a great business model because now you don't depend on paying users. Instead, you rely upon advertising revenue.

To help you pay your bills while you build your business, you may also be able to charge customers monthly.

This is the way that most internet entrepreneurs are able to make a living. Instead of making money, they are focused on providing value to others.

Why is personal finance so important?

A key skill to any success is personal financial management. We live in a world with tight finances and must make tough decisions about how we spend our hard earned cash.

Why then do we keep putting off saving money. Is there nothing better to spend our time and energy on?

Yes, and no. Yes, because most people feel guilty when they save money. Because the more money you earn the greater the opportunities to invest.

As long as you keep yourself focused on the bigger picture, you'll always be able to justify spending your money wisely.

Financial success requires you to manage your emotions. Negative thoughts will keep you from having positive thoughts.

Unrealistic expectations may also be a factor in how much you will end up with. This could be because you don't know how your finances should be managed.

Once you've mastered these skills, you'll be ready to tackle the next step - learning how to budget.

Budgeting refers to the practice of setting aside a portion each month for future expenses. You can plan ahead to avoid impulse purchases and have sufficient funds for your bills.

You now have the knowledge to efficiently allocate your resources and can start to see a brighter financial future.

Which side hustles are most lucrative?

A side hustle is an industry term for any additional income streams that supplement your main source of revenue.

Side hustles are important as they can provide additional income for bills or fun activities.

Side hustles may also allow you to save more money for retirement and give you more flexibility in your work schedule. They can even help you increase your earning potential.

There are two types. Side hustles that are passive include side businesses such as blogging, e-commerce and freelancing. You can also do side hustles like tutoring and dog walking.

Side hustles are smart and can fit into your life. A fitness business is a great option if you enjoy working out. If you enjoy spending time outdoors, consider becoming a freelance landscaper.

You can find side hustles anywhere. Side hustles can be found anywhere.

You might open your own design studio if you are skilled in graphic design. Or perhaps you have skills in writing, so why not become a ghostwriter?

Be sure to research thoroughly before you start any side hustle. This way, when the opportunity arises, you'll be ready to jump right in and take advantage of it.

Side hustles aren’t about making more money. They can help you build wealth and create freedom.

And with so many ways to earn money today, there's no excuse to start one!

What side hustles will be the most profitable in 2022

It is best to create value for others in order to make money. If you do this well the money will follow.

Although you may not be aware of it, you have been creating value from day one. Your mommy gave you life when you were a baby. Learning to walk gave you a better life.

You'll continue to make more if you give back to the people around you. Actually, the more that you give, the greater the rewards.

Without even realizing it, value creation is a powerful force everyone uses every day. You're creating value all day long, whether you're making dinner for your family or taking your children to school.

There are actually nearly 7 billion people living on Earth today. Each person is creating an amazing amount of value every day. Even if you create only $1 per hour of value, you would be creating $7,000,000 a year.

This means that you would earn $700,000.000 more a year if you could find ten different ways to add $100 each week to someone's lives. You would earn far more than you are currently earning working full-time.

Now let's pretend you wanted that to be doubled. Let's say that you found 20 ways each month to add $200 to someone else's life. Not only would this increase your annual income by $14.4 million, but it also makes you extremely rich.

There are millions of opportunities to create value every single day. Selling products, services and ideas is one example.

Although we tend to spend a lot of time focusing on our careers and income streams, they are just tools that allow us to achieve our goals. The real goal is to help other people achieve their goals.

Focus on creating value if you want to be successful. You can start by using my free guide: How To Create Value And Get Paid For It.

What is personal financial planning?

Personal finance is about managing your own money to achieve your goals at home and work. This includes understanding where your money is going and knowing how much you can afford. It also involves balancing what you want against what your needs are.

You can become financially independent by mastering these skills. That means you no longer have to depend on anyone for financial support. You no longer have to worry about paying rent or utilities every month.

Learning how to manage your finances will not only help you succeed, but it will also make your life easier. It makes you happier. If you are happy with your finances, you will be less stressed and more likely to get promoted quickly.

So who cares about personal finance? Everyone does! The most searched topic on the Internet is personal finance. According to Google Trends, searches for "personal finance" increased by 1,600% between 2004 and 2014.

People use their smartphones today to manage their finances, compare prices and build wealth. You can read blogs such as this one, view videos on YouTube about personal finances, and listen to podcasts that discuss investing.

Bankrate.com says that Americans spend on the average of four hours per day watching TV and listening to music. They also spend time surfing the Web, reading books, or talking with their friends. There are only two hours each day that can be used to do all the important things.

When you master personal finance, you'll be able to take advantage of that time.

What is the best passive income source?

There are many options for making money online. Many of these methods require more work and time than you might be able to spare. How can you make extra cash easily?

You need to find what you love. You can then monetize your passion.

For example, let's say you enjoy creating blog posts. Make a blog and share information on subjects that are relevant to your niche. You can then sign up your readers for email or social media by inviting them to click on the links contained in your articles.

This is called affiliate marketing, and there are plenty of resources to help you get started. Here are 101 affiliate marketing tips and resources.

As another source of passive income, you might also consider starting your own blog. You'll need to choose a topic that you are passionate about teaching. You can also make your site monetizable by creating ebooks, courses and videos.

While there are many methods to make money online there are some that are more effective than others. It is important to focus on creating websites and blogs that provide valuable information if your goal is to make money online.

After you have built your website, make sure to promote it on social media platforms like Facebook, Twitter and LinkedIn. This is known content marketing.

Statistics

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

External Links

How To

How to make money even if you are asleep

Online success requires that you learn to sleep well while awake. This means learning to do more than wait for someone to click on your link or buy your product. You must make money while you sleep.

You will need to develop an automated system that generates income without having to touch a single button. You must learn the art of automation to do this.

It would help if you became an expert at building software systems that perform tasks automatically. This will allow you to focus on your business while you sleep. You can even automate the tasks you do.

To find these opportunities, you should create a list with problems that you solve every day. Ask yourself if you can automate these problems.

Once you do that, you will probably find that there are many other ways to make passive income. The next step is to determine which option would be most lucrative.

If you're a webmaster, you might be able to create a website creator that automates the creation and maintenance of websites. You might also be able to create templates for logo production that you can use in an automated way if you're a graphic designer.

You could also create software programs that allow you to manage multiple clients at once if your business is established. There are many options.

You can automate anything as long you can think of a solution to a problem. Automation is the key to financial freedom.