Credit cards are an easy way to make purchases, but a personal loan is a better choice for long-term repayment. Both loans are secured by credit. You will need to consider your personal circumstances before making the right decision. Either one can be used to cover smaller or greater expenses. Both types have their pros and cons. It is important you weigh the pros before you make a final decision.

First, you must decide whether you need a mortgage or a credit card. A card lets you borrow money without the need to place collateral. This makes it more convenient. Personal loans may be a better option if you need to borrow substantial amounts of money.

The only difference between a personal loan and credit cards is the interest rates. Credit cards come with variable rates, while a personal loan usually has a fixed rate. A card with a lower credit rate might be a better deal depending on your credit history. If you are able to pay your balance off before the promotional period expires, you will be able to save significant amounts in interest costs.

There are some differences between a personal loan and credit card, but the most important is the repayment term. Lenders will typically limit you to borrowing for five years. Personal loans require you to make monthly payments. Like credit cards, you will have to make monthly payments if your credit score is negatively affected.

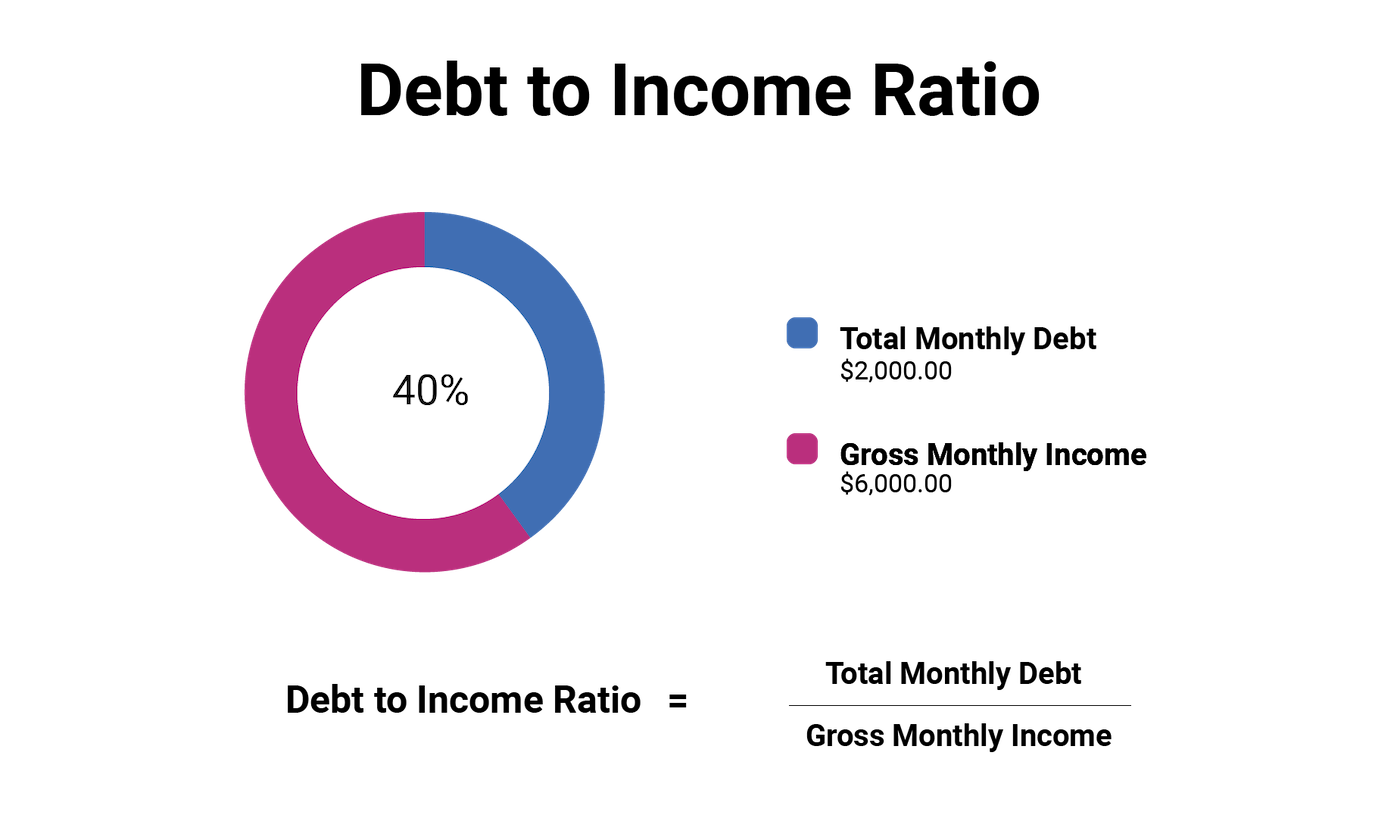

Personal loans have the advantage of being able to finance virtually anything. For example, you can use a personal loan to buy a new computer or vehicle. Personal loans are a great way of saving money. These loans are much easier to budget for and can be used to pay short-term expenses. But, it may be more advantageous to borrow with credit cards in the long term, especially if there is a low ratio of debt to income.

The amount of money you require is the most important consideration when choosing the right option. Both options will be able to finance your needs. However, it is important that you weigh the pros and cons before you make a decision.

The biggest problem with a credit card is the inability to control your spending. This is especially true for revolving credit lines. Another negative is that you don't have the security of a collateral line of credit. A personal loan can, however, be a good option to avoid paying interest. A home equity loan is another option, as they typically have a lower interest than credit card rates.

While both a personal loans and credit cards offer the convenience of borrowing money, a Credit Card is more beneficial if you are looking for the best bang for your dollar. Credit cards offer a few additional benefits such as quick financing, the ability to pay off balances and rewards. Some credit cards also offer cash back programs which can be a great way to earn extra money.

FAQ

How does a rich person make passive income?

There are two main ways to make money online. One way is to produce great products (or services) for which people love and pay. This is called "earning" money.

The second is to find a method to give value to others while not spending too much time creating products. This is called "passive" income.

Let's imagine you own an App Company. Your job is to develop apps. But instead of selling the apps to users directly, you decide that they should be given away for free. It's a great model, as it doesn't depend on users paying. Instead, you rely on advertising revenue.

You might charge your customers monthly fees to help you sustain yourself as you build your business.

This is how successful internet entrepreneurs today make their money. They focus on providing value to others, rather than making stuff.

What's the best way to make fast money from a side-hustle?

To make money quickly, you must do more than just create a product/service that solves a problem.

You also have to find a way to position yourself as an authority in whatever niche you choose to fill. It means building a name online and offline.

Helping people solve problems is the best way build a reputation. You need to think about how you can add value to your community.

Once you've answered that question, you'll immediately be able to figure out which areas you'd be most suited to tackle. There are many opportunities to make money online. But they can be very competitive.

If you are careful, there are two main side hustles. The first type is selling products and services directly, while the second involves offering consulting services.

Each method has its own pros and con. Selling services and products provides immediate gratification as you receive payment immediately after shipping your product or delivering your service.

But, on the other hand, you might not have the success you desire if you do not spend the time to build relationships with potential clientele. You will also find fierce competition for these gigs.

Consulting can help you grow your business without having to worry about shipping products and providing services. But, it takes longer to become an expert in your chosen field.

You must learn to identify the right clients in order to be successful at each option. This requires a little bit of trial and error. It pays off in the end.

What is the easiest way to make passive income?

There are many ways to make money online. Most of them take more time and effort than what you might expect. How do you find a way to earn more money?

The answer is to find something you love, whether blogging, writing, designing, selling, marketing, etc. It is possible to make money from your passion.

For example, let's say you enjoy creating blog posts. Start a blog where you share helpful information on topics related to your niche. When readers click on those links, sign them up to your email list or follow you on social networks.

This is affiliate marketing. There are lots of resources that will help you get started. For example, here's a list of 101 Affiliate Marketing Tools, Tips & Resources.

Another option is to start a blog. This time, you'll need a topic to teach about. However, once your site is established, you can make it more profitable by offering ebooks, videos and courses.

There are many online ways to make money, but the easiest are often the best. You can make money online by building websites and blogs that offer useful information.

Once you have created your website, share it on social media such as Facebook and Twitter. This is what's known as content marketing. It's a great way for you to drive traffic back your site.

How much debt is considered excessive?

It is important to remember that too much money can be dangerous. If you spend more than you earn, you'll eventually run out of cash because it takes time for savings to grow. Spend less if you're running low on cash.

But how much is too much? There's no right or wrong number, but it is recommended that you live within 10% of your income. Even after years of saving, this will ensure you won't go broke.

This means that you shouldn't spend more money than $10,000 a year if your income is $10,000. If you make $20,000, you should' t spend more than $2,000 per month. If you earn $50,000, you should not spend more than $5,000 per calendar month.

Paying off your debts quickly is the key. This applies to student loans, credit card bills, and car payments. Once these are paid off, you'll still have some money left to save.

It's best to think about whether you are going to invest any of the surplus income. If you decide to put your money toward stocks or bonds, you could lose money if the stock market falls. But if you choose to put it into a savings account, you can expect interest to compound over time.

For example, let's say you set aside $100 weekly for savings. It would add up towards $500 over five-years. Over six years, that would amount to $1,000. In eight years, your savings would be close to $3,000 When you turn ten, you will have almost $13,000 in savings.

You'll have almost $40,000 sitting in your savings account at the end of fifteen years. Now that's quite impressive. But if you had put the same amount into the stock market over the same time period, you would have earned interest. Instead of $40,000 you would now have $57,000.

It is important to know how to manage your money effectively. If you don't do this, you may end up spending far more than you originally planned.

What is the distinction between passive income, and active income.

Passive income can be defined as a way to make passive income without any work. Active income requires hard work and effort.

Your active income comes from creating value for someone else. If you provide a service or product that someone is interested in, you can earn money. Examples include creating a website, selling products online and writing an ebook.

Passive income can be a great option because you can put your efforts into more important things and still make money. But most people aren't interested in working for themselves. Therefore, they opt to earn passive income by putting their efforts and time into it.

The problem with passive income is that it doesn't last forever. You might run out of money if you don't generate passive income in the right time.

It is possible to burn out if your passive income efforts are too intense. You should start immediately. You will miss opportunities to maximize your earnings potential if you put off building passive income.

There are three types or passive income streams.

-

There are several options available for business owners: you can start a company, buy a franchise and become a freelancer. Or rent out your property.

-

Investments include stocks, bonds, mutual funds, ETFs, and ETFs.

-

Real Estate: This covers buying land, renting out properties, flipping houses and investing into commercial real estate.

Why is personal financial planning important?

A key skill to any success is personal financial management. We live in a world where money is tight, and we often have to make difficult decisions about how to spend our hard-earned cash.

Why do we delay saving money? What is the best thing to do with our time and energy?

Yes, and no. Yes, because most people feel guilty when they save money. Because the more money you earn the greater the opportunities to invest.

Spending your money wisely will be possible as long as you remain focused on the larger picture.

Controlling your emotions is key to financial success. Negative thoughts will keep you from having positive thoughts.

Your expectations regarding how much money you'll eventually accumulate may be unrealistic. This is because your financial management skills are not up to par.

After mastering these skills, it's time to learn how to budget.

Budgeting is the practice of setting aside some of your monthly income for future expenses. Planning will allow you to avoid buying unnecessary items and provide sufficient funds to pay your bills.

Now that you understand how to best allocate your resources, it is possible to start looking forward to a better financial future.

Statistics

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

External Links

How To

How passive income can improve cash flow

You don't have to work hard to make money online. Instead, there are passive income options that you can use from home.

Automating your business could be a benefit to an already existing company. Automating parts of your business workflow could help you save time, increase productivity, and even make it easier to start one.

The more automated your business becomes, the more efficient it will become. This means you will be able to spend more time working on growing your business rather than running it.

A great way to automate tasks is to outsource them. Outsourcing allows your business to be more focused on what is important. Outsourcing a task is effectively delegating it.

This means that you can focus on the important aspects of your business while allowing someone else to manage the details. Because you don't have to worry so much about the details, outsourcing makes it easier for your business to grow.

It is possible to make your hobby a side hustle. You can also use your talents to create an online product or service. This will help you generate additional cash flow.

For example, if you enjoy writing, why not write articles? You can publish articles on many sites. These websites allow you to make additional monthly cash by paying per article.

You can also consider creating videos. You can upload videos to YouTube and Vimeo via many platforms. Posting these videos will increase traffic to your social media pages and website.

Stocks and shares are another way to make some money. Investing in stocks and shares is similar to investing in real estate. However, instead of paying rent, you are paid dividends.

They are included in your dividend when shares you buy are purchased. The amount of your dividend will depend on how much stock is purchased.

If you decide to sell your shares, you will be able to reinvest the proceeds into new shares. You will keep receiving dividends for as long as you live.