Consolidating your existing debt can help lower your monthly payments. Consolidating your debt is not the right choice for everyone. Consider other options if your debt load is high or you have multiple loans.

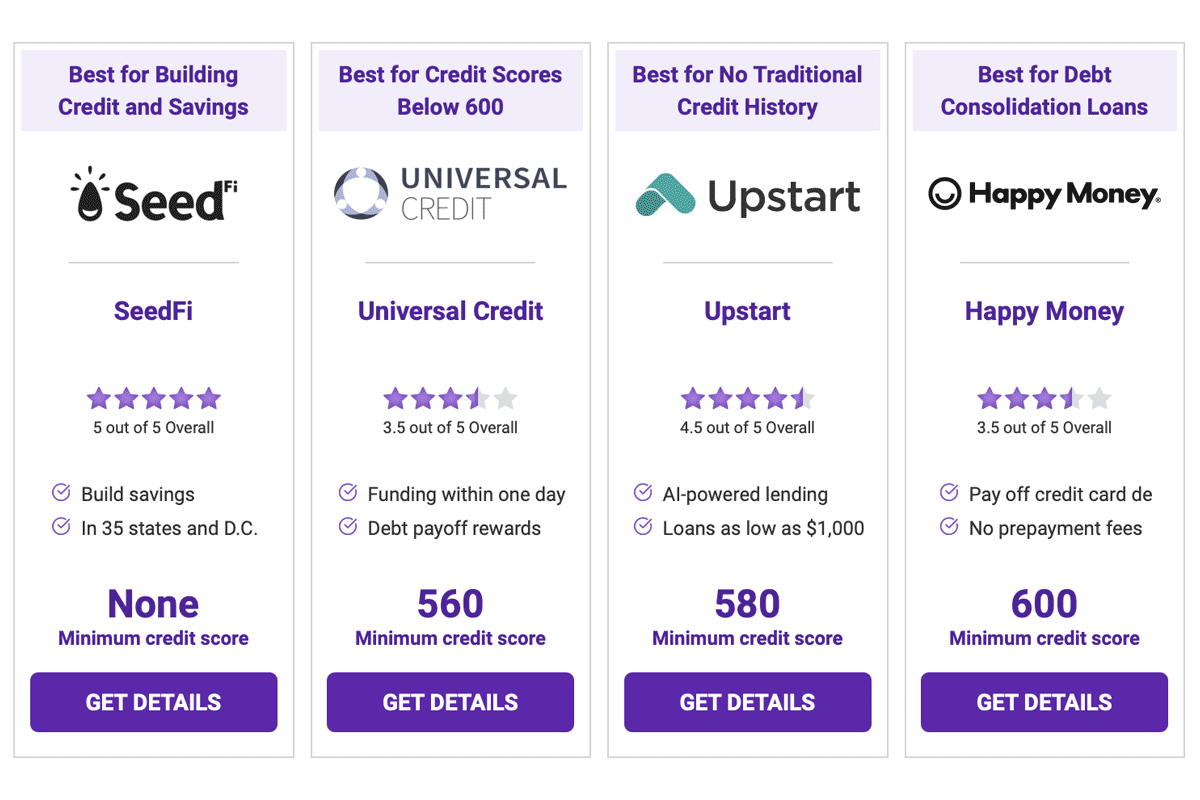

A personal loan is the most basic type of debt consolidation. You can choose to get a secured loan or an unsecured loan. It's a good idea to make sure that the loan is a good match for your situation. Credit rating is another important consideration. Strong credit scores will get you better terms for your loan.

Another option is to use a balance-transfer credit card. These cards usually come with a 12- to 21-month 0% APR. These cards typically have a credit limit of $500 and more. Although these cards can be used to consolidate debt, there is high risk.

The best way to consolidate debt for some is to take out a Home Equity Line of Credit (HELOC). HELOCs can be compared to credit cards. This loan lets you borrow money based on your home's worth. You must repay the loan in return. Using a HELOC can be beneficial for those with a large home equity amount.

Some debt consolidation companies charge fees and annual fees, which can add up. While debt consolidation will reduce your overall debt amount, you need to ensure you can still meet your monthly payment obligations. It's crucial to set a realistic budget, and to plan how you will repay the loan.

Consolidating your debts is a great choice to lower your bills and get you out of debt. This will improve your mental well-being and decrease your stress levels. However, you should keep in mind that consolidating your debt can take months to pay off. There may be multiple types of debt in your debt. These could include student loans, credit card debt and medical bills. It is possible to miss monthly payments if your due dates are different for multiple loans.

It might seem easier to consolidate debt by taking out a new mortgage, but it is not the best choice. You should also consider other options that will allow you to do something beyond paying off your existing debt. These include a loan to buy equity, a debt plan, and a balance transfer.

Another option is debt settlement. All of these are viable options, but they might not be suitable for you. There is no one-size fits all solution. Get advice from a financial professional before making any decisions about the path you want to take. Numerous nonprofits offer services in debt counseling for a small fee.

You may find it difficult to get out of debt. But with some planning and determination, you can achieve this goal. You can consolidate your debt by getting a credit line with a low APR. This will make it easier to repay your debt quicker.

FAQ

What is the fastest way you can make money in a side job?

If you really want to make money fast, you'll have to do more than create a product or service that solves a problem for someone.

It is also important to establish yourself as an authority in the niches you choose. It is important to establish a good reputation online as well offline.

Helping people solve problems is the best way build a reputation. Ask yourself how you can be of value to your community.

Once you've answered the question, you can immediately identify which areas of your expertise. There are many online ways to make money, but they are often very competitive.

You will see two main side hustles if you pay attention. The first involves selling products or services directly to customers. The second involves consulting services.

Each approach has pros and cons. Selling products and services provides instant gratification because once you ship your product or deliver your service, you receive payment right away.

But, on the other hand, you might not have the success you desire if you do not spend the time to build relationships with potential clientele. In addition, the competition for these kinds of gigs is fierce.

Consulting allows you to grow and manage your business without the need to ship products or provide services. But, it takes longer to become an expert in your chosen field.

It is essential to know how to identify the right clientele in order to succeed in each of these options. This requires a little bit of trial and error. But it will pay off big in the long term.

What side hustles are most lucrative in 2022?

You can make money by creating value for someone else. You will make money if you do this well.

While you might not know it, your contribution to the world has been there since day one. You sucked your mommy’s breast milk as a baby and she gave life to you. You made your life easier by learning to walk.

You'll continue to make more if you give back to the people around you. The truth is that the more you give, you will receive more.

Everyone uses value creation every day, even though they don't know it. It doesn't matter if you're cooking dinner or driving your kids to school.

There are actually nearly 7 billion people living on Earth today. That's almost 7 billion people on Earth right now. This means that each person creates a remarkable amount of value every single day. Even if your hourly value is $1, you could create $7 million annually.

That means that if you could find ten ways to add $100 to someone's life per week, you'd earn an extra $700,000 a year. This is a lot more than what you earn working full-time.

Let's imagine you wanted to make that number double. Let's assume you discovered 20 ways to make $200 more per month for someone. Not only would you earn another $14.4 million dollars annually, you'd also become incredibly wealthy.

Every single day, there are millions more opportunities to create value. This includes selling information, products and services.

Although our focus is often on income streams and careers, these are not the only things that matter. Ultimately, the real goal is to help others achieve theirs.

Focus on creating value if you want to be successful. Start by downloading my free guide, How to Create Value and Get Paid for It.

What is personal financial planning?

Personal finance refers to managing your finances in order to achieve your personal and professional goals. This means understanding where your money goes and what you can afford. And, it also requires balancing the needs of your wants against your financial goals.

By mastering these skills, you'll become financially independent, which means you don't depend on anyone else to provide for you. You can forget about worrying about rent, utilities, or any other monthly bills.

Learning how to manage your finances will not only help you succeed, but it will also make your life easier. It will make you happier. You will feel happier about your finances and be more satisfied with your life.

Who cares about personal finances? Everyone does! Personal finance is the most popular topic on the Internet. Google Trends has shown that searches for personal finance have increased 1,600% from 2004 to 2014.

People today use their smartphones to track their budgets, compare prices, build wealth, and more. You can read blogs such as this one, view videos on YouTube about personal finances, and listen to podcasts that discuss investing.

Bankrate.com reports that Americans spend four hours a days watching TV, listening, playing music, playing video games and surfing the web, as well as talking with their friends. Only two hours are left each day to do the rest of what is important.

You'll be able take advantage of your time when you understand personal finance.

How to build a passive income stream?

To consistently earn from one source, you need to understand why people buy what is purchased.

It means listening to their needs and desires. You must learn how to connect with people and sell to them.

Next, you need to know how to convert leads to sales. To retain happy customers, you need to be able to provide excellent customer service.

This is something you may not realize, but every product or service needs a buyer. If you know who this buyer is, your entire business can be built around him/her.

A lot of work is required to become a millionaire. You will need to put in even more effort to become a millionaire. Why? Because to become a millionaire, you first have to become a thousandaire.

Then, you will need to become millionaire. Finally, you can become a multi-billionaire. It is the same for becoming a billionaire.

So how does someone become a billionaire? It all starts with becoming a millionaire. All you need to do to achieve this is to start making money.

Before you can start making money, however, you must get started. So let's talk about how to get started.

How does rich people make passive income from their wealth?

There are two ways you can make money online. The first is to create great products or services that people love and will pay for. This is called "earning” money.

The second is to find a method to give value to others while not spending too much time creating products. This is known as "passive income".

Let's say you own an app company. Your job is developing apps. But instead of selling them directly to users, you decide to give them away for free. This is a great business model as you no longer depend on paying customers. Instead, your advertising revenue will be your main source.

To sustain yourself while you're building your company, you might also charge customers monthly fees.

This is how the most successful internet entrepreneurs make money today. Instead of making things, they focus on creating value for others.

What is the best passive income source?

There are many different ways to make online money. Many of these methods require more work and time than you might be able to spare. How can you make it easy for yourself to make extra money?

The answer is to find something you love, whether blogging, writing, designing, selling, marketing, etc. That passion can be monetized.

For example, let's say you enjoy creating blog posts. Make a blog and share information on subjects that are relevant to your niche. You can sign readers up for emails and social media by clicking on the links in the articles.

This is called affiliate marketing. You can find plenty of resources online to help you start. Here are 101 affiliate marketing tips and resources.

Another option is to start a blog. You'll need to choose a topic that you are passionate about teaching. Once you have established your website, you can make it a monetizable resource by selling ebooks, courses, and videos.

Although there are many ways to make money online you can choose the easiest. It is important to focus on creating websites and blogs that provide valuable information if your goal is to make money online.

Once your website is built, you can promote it via social media sites such as Facebook, Twitter, LinkedIn and Pinterest. This is content marketing. It's an excellent way to bring traffic back to your website.

Statistics

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

External Links

How To

How to Make Money Online

How to make money online today differs greatly from how people made money 10 years ago. You have to change the way you invest your money. There are many ways you can earn passive income. However, some require substantial upfront investment. Some methods can be more challenging than others. However, there are many things you need to do before investing your hard-earned funds in anything online.

-

Find out what kind investor you are. PTC sites are a great way to quickly make money. You get paid to click ads. If you're looking for long-term earning potential, affiliate marketing might be a good option.

-

Do your research. You must research any program before you decide to commit. Review, testimonials and past performance records are all good places to start. You don't wish to waste your energy and time only to discover that the product doesn’t perform.

-

Start small. Do not jump into a large project. Start small and build something first. This will let you gain experience and help you determine if this type of business suits you. When you feel confident, expand your efforts and take on bigger projects.

-

Get started now! It's never too late to start making money online. Even if your job has been full-time for many years, there is still plenty of time to create a portfolio of niche websites that are profitable. All that's required is a good idea as well as some commitment. Now is the time to get started!