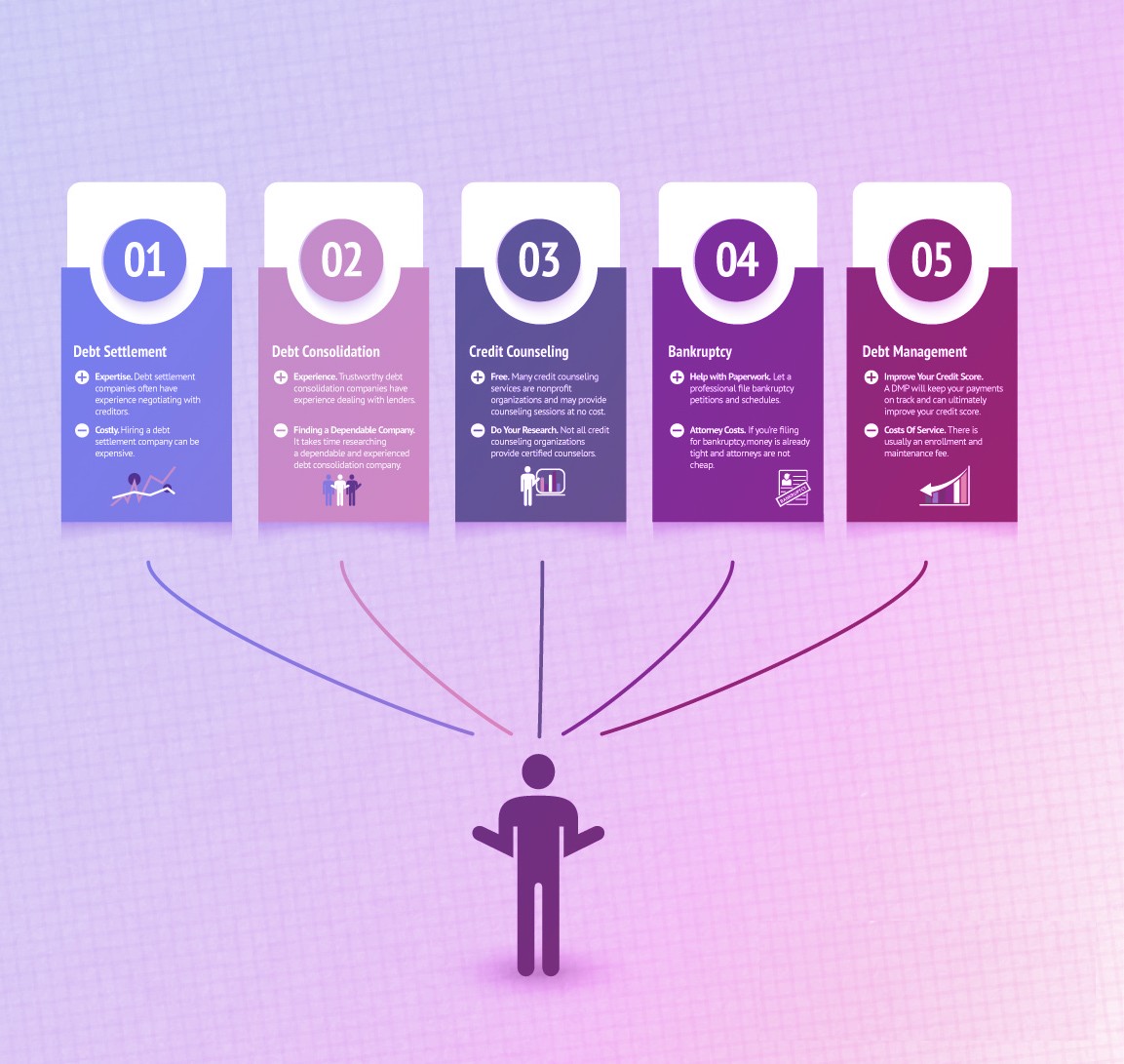

Debt consolidation can be beneficial for people with good credit. It will increase your chances of getting a low interest rate, which is important for saving money. You can also simplify your repayments by consolidating your loans. Consolidating your loans will allow you to pay off more in a shorter time. It all depends on what your situation is. Here are some pros and cons. If you have multiple high-interest credit card debts, you might consider debt consolidation.

Lower-interest debts reduce interest charges

The best way to reduce your interest payments is to pay off the lowest-interest debts first. This will reduce your interest rates and also improve your credit score. There are several methods to do this. You can use a snowball technique to pay off smaller amounts first. Or, you can use an avalanche strategy to take bigger steps at faster speeds.

You can also pay more often. If you pay more often, it is less likely that your payments will fall behind. Automating your payments will allow you to pay more promptly.

Lower-interest debts improve credit score

Credit card balances can be paid off to improve credit scores. This is because it lowers your credit utilization, which measures how many credit cards you use. Your credit utilization rate can be reduced by paying off any outstanding balance. It is possible to lower it to below 30%. While this is the best option, it's important to remember that credit card accounts' payment histories won't disappear once they are paid off. You will lose your credit score if you miss payments.

Another way to improve your credit score is to diversify your debts. By having several different types of debt, you can increase your total amount of available credit and lower your overall APR. This will improve your credit score and allow you to qualify for better terms. You can also improve your credit score by paying your bills on time.

Low-interest debts keep more debt away

2016 saw an average household debt of $16,000 and $132,500 in credit card debt. In today's economic climate, debt seems inevitable. Young people are especially susceptible to debt. There are however ways to control your debt and prevent it from growing.

Monthly payments will be lower if you have lower-interest debts

Consolidating debt is an effective way to improve your finances. But, it might not solve your underlying financial issues. It is crucial to carefully weigh the pros and cons of debt consolidation before making the final decision. Consolidating debt involves paying off multiple loans with one loan, or balance transfer credit cards at a lower cost.

You must first assess your financial situation. Once you have made a decision to consolidate your debt, you should make a plan for paying off the highest-interest loans first. If you are feeling stressed, you may choose to pay down lower-interest debts. You can also ask your lender to help you determine which debts need to be paid first.

Consolidating debt can be made easier by refinancing a mortgage or car loan.

The process of refinancing a car loan or mortgage may be a good way to consolidate debt and lower monthly payments. There are many auto lenders who offer these loans. It's worth looking at them. Before you apply for a refinance mortgage, it's important that you consider your credit history. Bad credit may limit your options and lead to high interest rates.

Refinancing car loans or mortgages to consolidate debt is simple. The first step to do this is to choose the type of consolidation loan. There are many options. These include a personal loan and credit card. Your financial situation may dictate other options.

FAQ

Which passive income is easiest?

There are many different ways to make online money. Some of these take more time and effort that you might realize. So how do you create an easy way for yourself to earn extra cash?

Find something that you are passionate about, whether it's writing, design, selling, marketing, or blogging. It is possible to make money from your passion.

For example, let's say you enjoy creating blog posts. Create a blog to share useful information on niche-related topics. Then, when readers click on links within those articles, sign them up for emails or follow you on social media sites.

Affiliate marketing is a term that can be used to describe it. There are many resources available to help you get started. Here's a collection of 101 affiliate marketing tips & resources.

You might also think about starting a blog to earn passive income. It's important to choose a topic you are passionate about. You can also make your site monetizable by creating ebooks, courses and videos.

Although there are many ways to make money online you can choose the easiest. You can make money online by building websites and blogs that offer useful information.

Once you've built your website, promote it through social media sites like Facebook, Twitter, LinkedIn, Pinterest, Instagram, YouTube and more. This is known content marketing.

How much debt is too much?

There is no such thing as too much cash. Spending more than what you earn can lead to cash running out. This is because savings takes time to grow. Spend less if you're running low on cash.

But how much can you afford? There's no right or wrong number, but it is recommended that you live within 10% of your income. This will ensure that you don't go bankrupt even after years of saving.

This means that even if you make $10,000 per year, you should not spend more then $1,000 each month. If you make $20,000, you should' t spend more than $2,000 per month. And if you make $50,000, you shouldn't spend more than $5,000 per month.

Paying off your debts quickly is the key. This applies to student loans, credit card bills, and car payments. Once these are paid off, you'll still have some money left to save.

It's best to think about whether you are going to invest any of the surplus income. If you choose to invest your money in bonds or stocks, you may lose it if the stock exchange falls. However, if you put your money into a savings account you can expect to see interest compound over time.

Consider, for example: $100 per week is a savings goal. That would amount to $500 over five years. At the end of six years, you'd have $1,000 saved. In eight years, your savings would be close to $3,000 When you turn ten, you will have almost $13,000 in savings.

After fifteen years, your savings account will have $40,000 left. Now that's quite impressive. However, this amount would have earned you interest if it had been invested in stock market during the exact same period. You'd have more than $57,000 instead of $40,000

It is important to know how to manage your money effectively. A poor financial management system can lead to you spending more than you intended.

What are the top side hustles that will make you money in 2022

It is best to create value for others in order to make money. If you do this well the money will follow.

You may not realize it now, but you've been creating value since day 1. You sucked your mommy’s breast milk as a baby and she gave life to you. You made your life easier by learning to walk.

As long as you continue to give value to those around you, you'll keep making more. You'll actually get more if you give more.

Everybody uses value creation every single day, without realizing it. You create value every day, whether you are cooking for your family, driving your children to school, emptying the trash or just paying the bills.

In actuality, Earth is home to nearly 7 billion people right now. That's almost 7 billion people on Earth right now. This means that each person creates a remarkable amount of value every single day. Even if only one hour is spent creating value, you can create $7 million per year.

If you could find ten more ways to make someone's week better, that's $700,000. You would earn far more than you are currently earning working full-time.

Now, let's say you wanted to double that number. Let's assume you discovered 20 ways to make $200 more per month for someone. Not only would you earn another $14.4 million dollars annually, you'd also become incredibly wealthy.

Every single day, there are millions more opportunities to create value. Selling products, services and ideas is one example.

Even though we spend much of our time focused on jobs, careers, and income streams, these are merely tools that help us accomplish our goals. Ultimately, the real goal is to help others achieve theirs.

To get ahead, you must create value. My free guide, How To Create Value and Get Paid For It, will help you get started.

How does rich people make passive income from their wealth?

If you're trying to create money online, there are two ways to go about it. The first is to create great products or services that people love and will pay for. This is called "earning" money.

A second option is to find a way of providing value to others without creating products. This is known as "passive income".

Let's imagine you own an App Company. Your job is developing apps. Instead of selling apps directly to users you decide to give them away free. That's a great business model because now you don't depend on paying users. Instead, advertising revenue is your only source of income.

You might charge your customers monthly fees to help you sustain yourself as you build your business.

This is how the most successful internet entrepreneurs make money today. They focus on providing value to others, rather than making stuff.

Why is personal financing important?

Personal financial management is an essential skill for anyone who wants to succeed. We live in a world with tight finances and must make tough decisions about how we spend our hard earned cash.

So why should we wait to save money? Is there anything better to spend our energy and time on?

Yes and no. Yes, most people feel guilty saving money. You can't, as the more money that you earn, you have more investment opportunities.

You'll always be able justify spending your money wisely if you keep your eyes on the bigger picture.

Financial success requires you to manage your emotions. When you focus on the negative aspects of your situation, you won't have any positive thoughts to support you.

It is possible to have unrealistic expectations of how much you will accumulate. This could be because you don't know how your finances should be managed.

These skills will prepare you for the next step: budgeting.

Budgeting is the act or practice of setting aside money each month to pay for future expenses. Planning will allow you to avoid buying unnecessary items and provide sufficient funds to pay your bills.

You now have the knowledge to efficiently allocate your resources and can start to see a brighter financial future.

What is the fastest way you can make money in a side job?

If you want money fast, you will need to do more than simply create a product/service to solve a problem.

It is also important to establish yourself as an authority in the niches you choose. This means that you need to build a reputation both online and offline.

Helping others solve problems is the best way to establish a reputation. So you need to ask yourself how you can contribute value to the community.

Once you've answered the question, you can immediately identify which areas of your expertise. There are many ways to make money online.

If you are careful, there are two main side hustles. The one involves selling direct products and services to customers. While the other involves providing consulting services.

Each method has its own pros and con. Selling services and products provides immediate gratification as you receive payment immediately after shipping your product or delivering your service.

But, on the other hand, you might not have the success you desire if you do not spend the time to build relationships with potential clientele. In addition, the competition for these kinds of gigs is fierce.

Consulting allows you to grow your business without worrying about shipping products or providing services. But, it takes longer to become an expert in your chosen field.

It is essential to know how to identify the right clientele in order to succeed in each of these options. This requires a little bit of trial and error. However, the end result is worth it.

Statistics

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

External Links

How To

How to Make Money While You Are Asleep

It is essential that you can learn to sleep while you are awake in order to be successful online. This means you need to be able do more than wait for someone else to click your link or purchase your product. You must make money while you sleep.

This means you must create an automated system to make money, without even lifting a finger. Automating is the key to success.

It would be beneficial to learn how to build software systems that do tasks automatically. That way, you can focus on making money while you sleep. You can automate your job.

It is best to keep a running list of the problems you face each day to help you find these opportunities. Next, ask yourself if there are any ways you could automate them.

Once you have done this, you will likely realize that there are many ways you can generate passive income. Now, it's time to find the most lucrative.

Perhaps you can create a website building tool that automates web design if, for example, you are a webmaster. If you are a designer, you might be able create templates that automate the creation of logos.

Or, if you own a business, perhaps you could create a software program that allows you to manage multiple clients simultaneously. There are hundreds to choose from.

Automating anything is possible as long as your creativity can solve a problem. Automating is key to financial freedom.