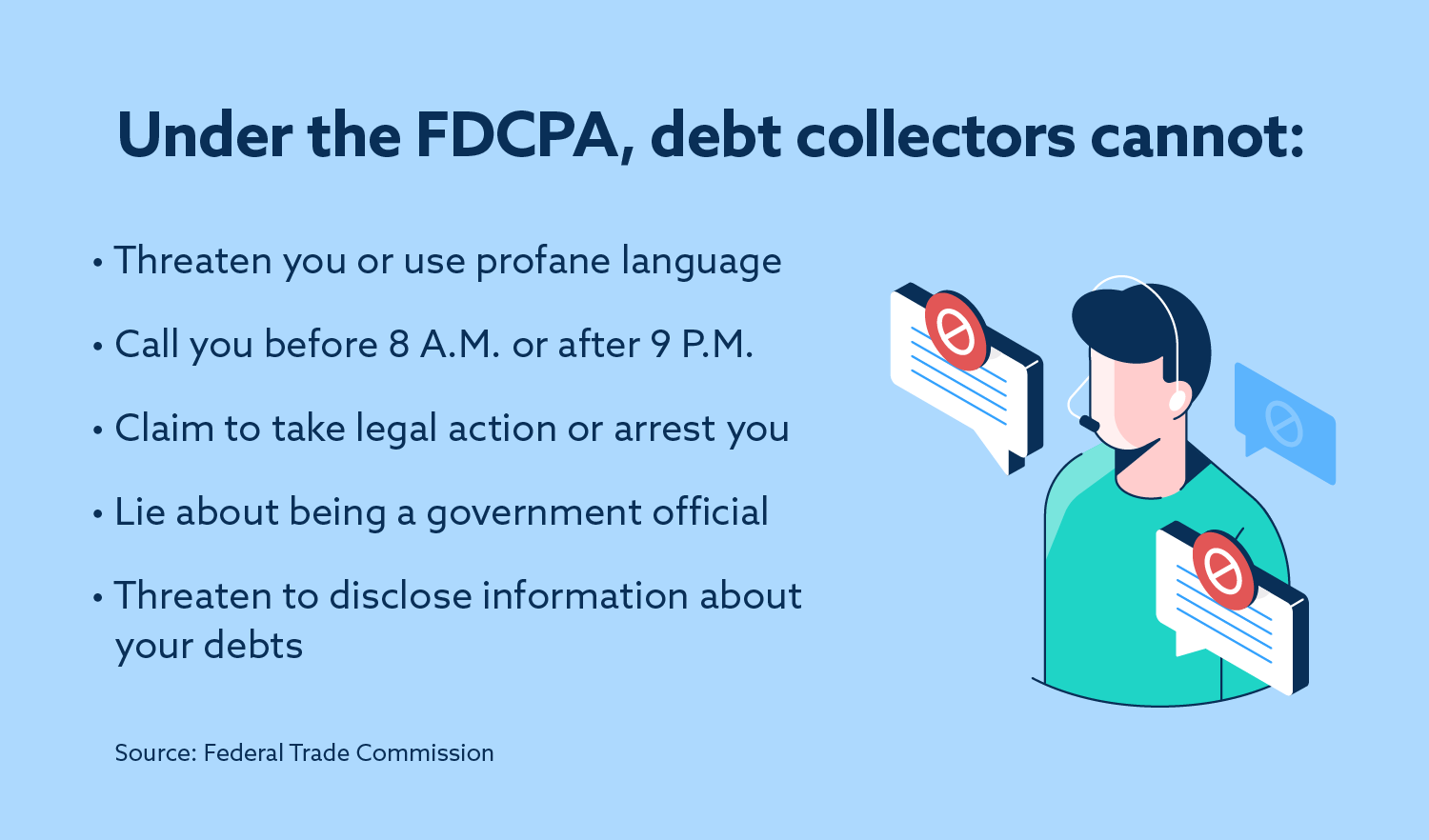

You need to be aware of your rights in the event that you are sued regarding credit card debt. The debt collection agency could be using strong-arm tactics against you. It may even mislead about the amount of your debt. A lawyer will be necessary to protect your rights in such cases. Certain rights are available to you, as outlined in your credit card agreement.

If you are sued over credit card debt

If your credit card company has filed a suit against you for failing to make payments on time, This can be a difficult situation to be in, but it doesn't have to be hopeless. You can often settle your debts without having to go to court. It is possible to obtain legal advice.

Credit card debt collection agencies are aggressive and can threaten you. Sometimes they won't even give you the amount of money that you owe. To negotiate with debt collectors, you may need to engage a lawyer. Your rights to settle your debt are yours. It is important to keep in mind that credit card agreements have fine print that outlines what you must do.

Common defenses that you can use in a lawsuit

You can usually use the following defenses to defend yourself in a lawsuit to pay off your credit card debt. This is because the credit card company might have sold your account information on to another agency without a legal basis to sue. This defense can be very useful if the creditcard company was mistaken about the identity the person who made these charges.

A credit card company may also be able to claim that they waited too long before filing a lawsuit to resolve your credit card debt. This is called a "statute of limitations" defense, and it can lead to the dismissal of your case. A consultation with an attorney is crucial before you decide to file a suit.

Whether you should represent yourself in a lawsuit

It is possible to feel overwhelmed and scared if you have unpaid bills and are being sued by a credit-card company. You have options. If you prefer to represent yourself in court, you can tell your side of the story. This could affect the outcome of your lawsuit.

A debt collection agency may use strong-arm tactics to try to collect the debt. Their assessment might not be accurate. You should be aware of your rights as credit card users if you decide to represent yourself. These rights can be found in the fine print within your credit agreement. You should be aware of these rights and protect them.

Talking to a credit card company about a settlement

There are many factors that could influence the willingness of a creditcard company to settle with you. The first is your outstanding balance. The credit card company is unlikely to negotiate with someone who is already behind in payments. It needs to verify that you are able to afford the settlement amount. The second factor is the interest you are currently paying.

First, call the credit card company. To speak to someone in the debt settlements team, call their customer service number. Explain your situation. Explain that you are in dire circumstances and that you don't have the finances to pay your monthly expenses. You should mention if you have more than one account. This will make them more likely to offer you a fair price.

Before you sign up for a debt settlement program, do your research.

Debt settlement programs can come with many risks. Make sure you do your research thoroughly before signing up. One of the most significant risks is that credit scores could be affected. Your credit score will be affected less if you have accounts that are not in good standing and more if they're already behind. Larger balances can have a greater impact on your credit score than smaller ones. You should ensure you are able to afford the debt settlement payments before enrolling in one.

One risk of debt settlement programs could be that you end up in deeper debt than you were before. Some companies will request that you stop making payments to creditors. This can negatively affect your credit rating. In addition to penalties and late fees, this could result in you being charged additional fees. In the event that you do not make payments, you could be subject to legal action. A lawsuit will also allow your creditors to garnish your wages or put a lien on your home.

FAQ

Which passive income is easiest?

There are tons of ways to make money online. Most of them take more time and effort than what you might expect. How do you make extra cash easy?

Find something that you are passionate about, whether it's writing, design, selling, marketing, or blogging. and monetize that passion.

For example, let's say you enjoy creating blog posts. Create a blog to share useful information on niche-related topics. You can sign readers up for emails and social media by clicking on the links in the articles.

Affiliate marketing is a term that can be used to describe it. There are many resources available to help you get started. Here's a list with 101 tips and resources for affiliate marketing.

Another option is to start a blog. You'll need to choose a topic that you are passionate about teaching. After you've created your website, you can start offering ebooks and courses to make money.

There are many ways to make money online, but the best ones are usually the simplest. Make sure you focus your efforts on creating useful websites and blogs if you truly want to make a living online.

Once your website is built, you can promote it via social media sites such as Facebook, Twitter, LinkedIn and Pinterest. This is what's known as content marketing. It's a great way for you to drive traffic back your site.

What is the difference between passive income and active income?

Passive income refers to making money while not working. Active income requires effort and hard work.

When you make value for others, that is called active income. When you earn money because you provide a service or product that someone wants. Examples include creating a website, selling products online and writing an ebook.

Passive income can be a great option because you can put your efforts into more important things and still make money. Many people aren’t interested in working for their own money. Therefore, they opt to earn passive income by putting their efforts and time into it.

Passive income isn't sustainable forever. If you hold off too long in generating passive income, you may run out of cash.

In addition to the danger of burnout, if you spend too many hours trying to generate passive income, It is best to get started right away. You will miss opportunities to maximize your earnings potential if you put off building passive income.

There are three types to passive income streams.

-

There are several options available for business owners: you can start a company, buy a franchise and become a freelancer. Or rent out your property.

-

Investments - These include stocks, bonds and mutual funds as well ETFs.

-

Real Estate - this includes rental properties, flipping houses, buying land, and investing in commercial real estate

Why is personal finance so important?

Personal financial management is an essential skill for anyone who wants to succeed. Our world is characterized by tight budgets and difficult decisions about how to spend it.

So why should we wait to save money? Is there anything better to spend our energy and time on?

Yes, and no. Yes, because most people feel guilty if they save money. You can't, as the more money that you earn, you have more investment opportunities.

You'll always be able justify spending your money wisely if you keep your eyes on the bigger picture.

Financial success requires you to manage your emotions. If you are focusing on the negative aspects of your life, you will not have positive thoughts that can support you.

Unrealistic expectations may also be a factor in how much you will end up with. This is because you aren't able to manage your finances effectively.

Once you have mastered these skills you will be ready for the next step, learning how budgeting works.

Budgeting refers to the practice of setting aside a portion each month for future expenses. Planning will save you money and help you pay for your bills.

You now have the knowledge to efficiently allocate your resources and can start to see a brighter financial future.

Is there a way to make quick money with a side hustle?

If you want money fast, you will need to do more than simply create a product/service to solve a problem.

It is also important to establish yourself as an authority in the niches you choose. This means that you need to build a reputation both online and offline.

The best way to build a reputation is to help others solve problems. It is important to consider how you can help the community.

Once you've answered the question, you can immediately identify which areas of your expertise. There are many online ways to make money, but they are often very competitive.

When you really look, you will notice two main side hustles. One involves selling products directly to customers and the other is offering consulting services.

There are pros and cons to each approach. Selling services and products provides immediate gratification as you receive payment immediately after shipping your product or delivering your service.

The flip side is that you won't be able achieve the level you desire without building relationships and trust with potential clients. You will also find fierce competition for these gigs.

Consulting is a great way to expand your business, without worrying about shipping or providing services. However, it can take longer to be recognized as an expert in your area.

In order to succeed at either option, you need to learn how to identify the right clientele. It takes some trial and error. It pays off in the end.

How to make passive income?

To make consistent earnings from one source you must first understand why people purchase what they do.

That means understanding their needs and wants. This requires you to be able connect with people and make sales to them.

You must then figure out how you can convert leads into customers. You must also master customer service to retain satisfied clients.

This is something you may not realize, but every product or service needs a buyer. If you know the buyer, you can build your entire business around him/her.

To become a millionaire takes hard work. A billionaire requires even more work. Why? To become a millionaire you must first be a thousandaire.

Then, you will need to become millionaire. The final step is to become a millionaire. The same is true for becoming billionaire.

How does one become a billionaire, you ask? You must first be a millionaire. To achieve this, all you have to do is start earning money.

You must first get started before you can make money. Let's take a look at how we can get started.

How can rich people earn passive income?

There are two options for making money online. One way is to produce great products (or services) for which people love and pay. This is called earning money.

A second option is to find a way of providing value to others without creating products. This is what we call "passive" or passive income.

Let's imagine you own an App Company. Your job is to create apps. You decide to make them available for free, instead of selling them to users. This business model is great because it does not depend on paying users. Instead, you rely upon advertising revenue.

To sustain yourself while you're building your company, you might also charge customers monthly fees.

This is how successful internet entrepreneurs today make their money. Instead of making things, they focus on creating value for others.

Statistics

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

External Links

How To

How to Make Money Online

Today's methods of making money online are very different from those used ten years ago. It is changing how you invest your money. There are many ways that you can make passive income. But, they all require a large initial investment. Some methods are easier than others. But if you want to make real money online, there are some things you should consider before investing your hard-earned cash into anything.

-

Find out who you are as an investor. PTC sites, which allow you to earn money by clicking on ads, might appeal to you if you are looking for quick cash. If you're looking for long-term earning potential, affiliate marketing might be a good option.

-

Do your research. Before you commit to any program, you must do your homework. Review, testimonials and past performance records are all good places to start. You don't want to waste your time and energy only to realize that the product doesn't work.

-

Start small. Don't just jump right into one big project. Instead, you should start by building something small. This will enable you to get the basics down and make a decision about whether or not this type of business is for your. After you feel confident enough, you can start working on larger projects.

-

Get started now! It is never too late to make money online. Even if you've been working full-time for years, you still have plenty of time left to build a solid portfolio of profitable niche websites. All that's required is a good idea as well as some commitment. So go ahead and take action today!