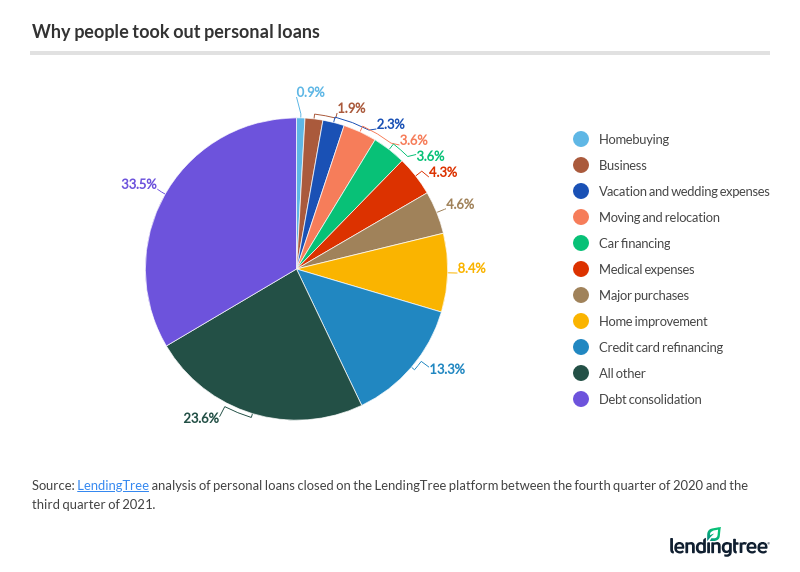

There are many benefits to debt consolidation in comparison to bankruptcy. While it will cost you more, you might find it a better choice if you are looking to make a large purchase. In addition, bankruptcy can damage your credit score. A consolidation of debt might make sense if your goal is to purchase a new car or home.

Chapter 7 bankruptcy

Chapter 7 bankruptcy may be an option for you if your debts are too overwhelming. Bankruptcy won't completely erase your debt. However, it will reduce your monthly payments as well as eliminate interest costs. Chapter 7 bankruptcy is still required to sell any non-exempt items, such as your home and car. You should choose carefully which bankruptcy option you prefer.

In Chapter 7 bankruptcy, your assets are sold off to pay off your creditors. In some cases, you can still keep some of your assets and avoid paying back the full amount of your debt. A debt management plan may suit you better if you have a job and an income. Chapter 7 bankruptcy, however, is a better option if you are unable to make your debt payments.

Consolidate your debt

It depends on your financial situation whether you want to consolidate debt or go bankrupt. The former offers lower interest rates while the latter helps protect your credit. While both options can be effective, not everyone is able to use them. Before you decide which is best for you, consider the pros and cons of each. In general, debt consolidation is a better option for those who have poor credit, but you should weigh the risks before making a decision.

Your credit score can be affected by bankruptcy. Also, bankruptcy filings can have high costs. If you can afford your monthly payments and have been spending excessively on credit cards, it may be a better choice.

InCharge counseling

InCharge offers a variety credit counseling services, including counseling for student loans, debt consolidation, and debt management programs. InCharge is also a leader in pre-file credit counseling and bankruptcy education. The company provides a range of educational resources as well as webinars through local partners for those who are considering bankruptcy filings. Clients can also access their accounts via a mobile app. Clients can access their account status from anywhere, add new creditors and modify payment dates.

While bankruptcy is a drastic option, it can be an effective way to overcome debt and get back on your feet. However, it can also cause lasting damage to your credit score. Bankruptcy doesn't erase all debts. It can be mentally draining to file for bankruptcy. Some people choose credit counseling over filing for bankruptcy.

Credit score and the impact of bankruptcy

There are many factors that can impact the impact of bankruptcy on credit scores. Two of the most important factors in this analysis are the amount of debt you have eliminated and the ratio of available credit to debt. You will need to start again from scratch after filing bankruptcy. However, there are steps you can take that will help you improve your credit score.

It is important to first understand the effect of bankruptcy on your credit score. A bankruptcy can reduce your credit score by between 130 and 200 points. This is quite a drastic drop. The effect will gradually diminish. Once you file for bankruptcy you should concentrate on building credit and making new financial decisions. When deciding whether or not to extend credit, most credit card companies take into account your credit history.

FAQ

What is the fastest way to make money on a side hustle?

If you really want to make money fast, you'll have to do more than create a product or service that solves a problem for someone.

It is also important to establish yourself as an authority in the niches you choose. It is important to establish a good reputation online as well offline.

Helping others solve problems is the best way to establish a reputation. It is important to consider how you can help the community.

Once you've answered the question, you can immediately identify which areas of your expertise. There are countless ways to earn money online, and even though there are plenty of opportunities, they're often very competitive.

But when you look closely, you can see two main side hustles. The first type is selling products and services directly, while the second involves offering consulting services.

Each approach has its advantages and disadvantages. Selling products or services offers instant gratification, as once your product is shipped or your service is delivered, you will receive payment immediately.

The flip side is that you won't be able achieve the level you desire without building relationships and trust with potential clients. Additionally, there is intense competition for these types of gigs.

Consulting is a great way to expand your business, without worrying about shipping or providing services. But it takes longer to establish yourself as an expert in your field.

It is essential to know how to identify the right clientele in order to succeed in each of these options. This takes some trial and errors. But it will pay off big in the long term.

What is personal finances?

Personal finance is the art of managing your own finances to help you achieve your financial goals. This involves knowing where your money is going, what you can afford, as well as balancing your wants and needs.

Learning these skills will make you financially independent. You won't need to rely on anyone else for your needs. You don't need to worry about monthly rent and utility bills.

And learning how to manage your money doesn't just help you get ahead. It will make you happier. If you are happy with your finances, you will be less stressed and more likely to get promoted quickly.

So who cares about personal finance? Everyone does! Personal finance is a very popular topic today. Google Trends reports that the number of searches for "personal financial" has increased by 1,600% since 2004.

People today use their smartphones to track their budgets, compare prices, build wealth, and more. You can find blogs about investing here, as well as videos and podcasts about personal finance.

Bankrate.com says that Americans spend on the average of four hours per day watching TV and listening to music. They also spend time surfing the Web, reading books, or talking with their friends. Only two hours are left each day to do the rest of what is important.

Financial management will allow you to make the most of your financial knowledge.

How does a rich person make passive income?

If you're trying to create money online, there are two ways to go about it. One way is to produce great products (or services) for which people love and pay. This is called earning money.

A second option is to find a way of providing value to others without creating products. This is "passive" income.

Let's suppose you have an app company. Your job is developing apps. You decide to give away the apps instead of making them available to users. This business model is great because it does not depend on paying users. Instead, your advertising revenue will be your main source.

Customers may be charged monthly fees in order to sustain your business while you are building it.

This is the way that most internet entrepreneurs are able to make a living. They give value to others rather than making stuff.

Which side hustles are the most lucrative in 2022

The best way today to make money is to create value in the lives of others. This will bring you the most money if done well.

You may not realize it now, but you've been creating value since day 1. As a baby, your mother gave you life. You made your life easier by learning to walk.

Giving value to your friends and family will help you make more. You'll actually get more if you give more.

Without even realizing it, value creation is a powerful force everyone uses every day. You create value every day, whether you are cooking for your family, driving your children to school, emptying the trash or just paying the bills.

In fact, there are nearly 7 billion people on Earth right now. That means that each person is creating a staggering amount of value daily. Even if your hourly value is $1, you could create $7 million annually.

That means that if you could find ten ways to add $100 to someone's life per week, you'd earn an extra $700,000 a year. Imagine that you'd be earning more than you do now working full time.

Let's say that you wanted double that amount. Let's say that you found 20 ways each month to add $200 to someone else's life. You would not only be able to make $14.4 million more annually, but also you'd become very wealthy.

Every day offers millions of opportunities to add value. This includes selling products, ideas, services, and information.

Although many of us spend our time thinking about careers and income streams, these tools are only tools that enable us to reach our goals. Ultimately, the real goal is to help others achieve theirs.

To get ahead, you must create value. Use my guide How to create value and get paid for it.

Why is personal financing important?

Anyone who is serious about financial success must be able to manage their finances. We live in a world where money is tight, and we often have to make difficult decisions about how to spend our hard-earned cash.

Why then do we keep putting off saving money. Is it not better to use our time or energy on something else?

Yes, and no. Yes, most people feel guilty saving money. You can't, as the more money that you earn, you have more investment opportunities.

Spending your money wisely will be possible as long as you remain focused on the larger picture.

You must learn to control your emotions in order to be financially successful. If you are focusing on the negative aspects of your life, you will not have positive thoughts that can support you.

Also, you may have unrealistic expectations about the amount of money that you will eventually accumulate. This could be because you don't know how your finances should be managed.

After mastering these skills, it's time to learn how to budget.

Budgeting is the act or practice of setting aside money each month to pay for future expenses. You can plan ahead to avoid impulse purchases and have sufficient funds for your bills.

So now that you know how to allocate your resources effectively, you can begin to look forward to a brighter financial future.

How do you build passive income streams?

You must understand why people buy the things they do in order to generate consistent earnings from a single source.

It is important to understand people's needs and wants. You need to know how to connect and sell to people.

The next step is to learn how to convert leads in to sales. To retain happy customers, you need to be able to provide excellent customer service.

Every product or service has a buyer, even though you may not be aware of it. Knowing who your buyer is will allow you to design your entire company around them.

To become a millionaire it takes a lot. It takes even more to become billionaire. Why? To become a millionaire you must first be a thousandaire.

Finally, you can become a millionaire. Finally, you must become a billionaire. The same is true for becoming billionaire.

How can someone become a billionaire. It all starts with becoming a millionaire. All you have to do in order achieve this is to make money.

Before you can start making money, however, you must get started. So let's talk about how to get started.

Statistics

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

External Links

How To

How to Make Money Online

The way people make money online today is very different than 10 years ago. How you invest your funds is changing as well. There are many ways that you can make passive income. But, they all require a large initial investment. Some methods are easier than other. However, there are many things you need to do before investing your hard-earned funds in anything online.

-

Find out who you are as an investor. You might be attracted to PTC sites (Pay per Click), which pay you for clicking ads. You might also consider affiliate marketing opportunities if your goal is to make long-term money.

-

Do your research. Research is essential before you make any commitment to any program. Check out past performance records and testimonials before you commit to any program. You don't want your time or energy wasted only to discover that the product doesn’t work.

-

Start small. Don't just jump right into one big project. Instead, build something small first. This will let you gain experience and help you determine if this type of business suits you. Once you feel confident enough, try expanding your efforts to bigger projects.

-

Get started now! It's never too early to begin making money online. Even if a long-term employee, there's still time to build up a profitable portfolio of niche websites. All you need are a great idea and some dedication. So go ahead and take action today!