Consolidation Loans are a way to reduce your debt by repaying several smaller loans. It involves identifying each debt obligation and applying for a single loan. Then, the debts are paid off in a fixed payment cycle. You would need two loans for an obligation of Rs 3000000. One loan would be for two years at 12% interest, and the other for ten years at 10% interest.

Unsecured loans can't be consolidated with an unsecured loan

Even though unsecured loans don't have collateral, you could still be held responsible for non-payments. You will be charged additional interest fees and late fees for any missed payments. Late payments will also show up on your credit report for seven years. In some cases, you could even have your account placed in collections. While it may seem like a bad idea, unsecured loans can help you pay off debt.

If you find yourself in default on your unsecured loans, the best thing is to contact your lender and explain your financial situation. The lender may offer assistance in repaying your debt, such as lowering the monthly payment or waiving over-the-limit fees. In an emergency, some lenders will lower your interest rate temporarily.

Unsecured Loans require income proof

An unsecured loan requires you to provide proof of income to receive the loan. To determine if you are financially able to pay the loan off, the lender will evaluate your credit and income. The interest rate is also determined by the amount you owe relative to your income. You may be eligible for a lower interest rate when you have good credit. If you intend to obtain a larger personal loan, proof of income may be required.

You can use bank statements, pay stubs, or tax returns to prove your income. Other financial information may be required by lenders, such as proof that you have received benefits. Make sure to verify with your lender that you have all the information you require.

Unsecured loans can be combined with an unsecured Loan

You have the option of applying for an unsecured loan to consolidate debt. It is flexible and easier than you might think. Unsecured loans are available online and in person. These loans are offered by many different lenders. These include local banks and credit unions. Non-bank financial institutions such as insurance companies or peer-to-peer lending can also provide unsecured loans.

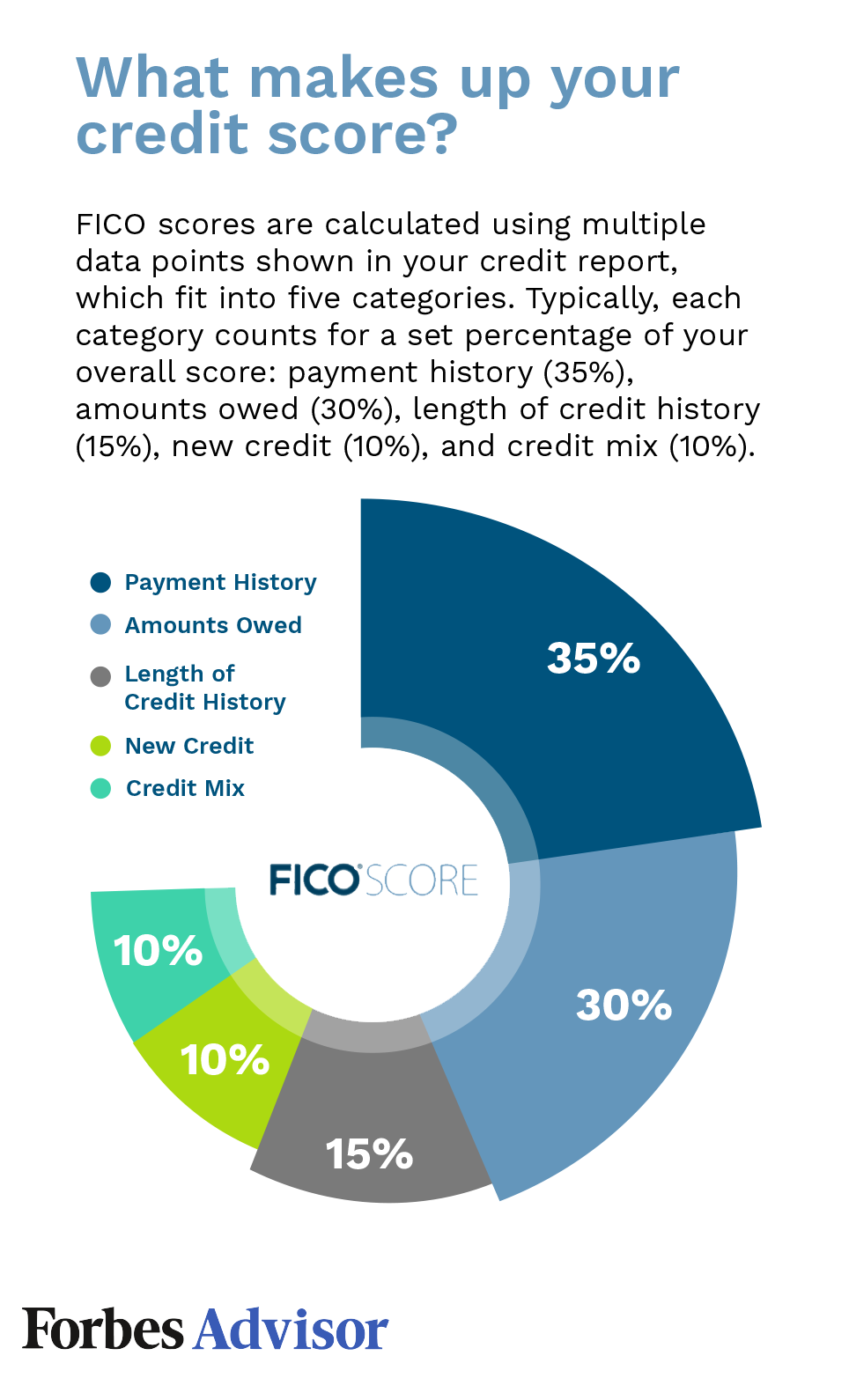

Unsecured loans are not tied to collateral. Your lender cannot take your assets if your defaults. Failure to pay a loan on a timely basis can result in a severe reduction of your credit score, which is often measured using a number called FICO. Low credit scores can make it more difficult to get credit or even lead to foreclosure.

Consolidate student loans

Consolidating student loans is when you combine multiple student loans into one. This can reduce monthly repayments and allow for longer loan terms. Consolidation loans are available through the Federal Direct Student Loan Program. Consolidating student loan debts has many advantages. The process can be very rewarding because it offers lower interest rates, longer terms and fewer monthly payments.

Consolidating student loans can help you get out of the cycle where you have to make multiple monthly payments. When you only have one bill to make each month, you can stay organized and make your payments on time. Multi-loan debt can make it difficult and easy to miss one payment. Student loan consolidation can help organize your finances and ensure that you make all your payments on schedule. Late payments can negatively impact your credit score, even though you might not know it.

Consolidating home equity loans

Consolidating debts can be done with a home equity loan. This loan comes with lower interest and payments. You should weigh the pros and cons of this loan before taking it out. Your home could be in danger if your financial situation changes. It is important to consider all of your options before applying for a home-equity loan.

A home equity credit line of credit is an alternative to consolidating home equity loans. These loans are revolving credit lines and allow you to borrow against your house to repay your debts. Home equity lines of credit have fixed interest rates, which is different from traditional loans. They can also be used for many purposes. You should look into other options for debt consolidation if you are in too much debt or have not enough equity to be eligible for a home equity line of credit.

FAQ

What is the easiest way to make passive income?

There are many online ways to make money. Many of these methods require more work and time than you might be able to spare. How can you make extra cash easily?

Finding something you love is the key to success, be it writing, selling, marketing or designing. That passion can be monetized.

For example, let's say you enjoy creating blog posts. Start a blog where you share helpful information on topics related to your niche. You can sign readers up for emails and social media by clicking on the links in the articles.

This is known as affiliate marketing and you can find many resources to help get started. For example, here's a list of 101 Affiliate Marketing Tools, Tips & Resources.

As another source of passive income, you might also consider starting your own blog. It's important to choose a topic you are passionate about. Once you have established your website, you can make it a monetizable resource by selling ebooks, courses, and videos.

There are many online ways to make money, but the easiest are often the best. Focus on creating websites or blogs that offer valuable information if you want to make money in the online world.

After you have built your website, make sure to promote it on social media platforms like Facebook, Twitter and LinkedIn. This is content marketing. It's an excellent way to bring traffic back to your website.

How to build a passive income stream?

To earn consistent earnings from the same source, it is important to understand why people make purchases.

It means listening to their needs and desires. It is important to learn how to communicate with people and to sell to them.

You must then figure out how you can convert leads into customers. To retain happy customers, you need to be able to provide excellent customer service.

Although you might not know it, every product and service has a customer. And if you know who that buyer is, you can design your entire business around serving him/her.

It takes a lot of work to become a millionaire. It takes even more to become billionaire. Why? It is because you have to first become a 1,000aire before you can become a millionaire.

Then you must become a millionaire. Finally, you can become a multi-billionaire. It is the same for becoming a billionaire.

So how does someone become a billionaire? Well, it starts with being a thousandaire. All you have to do in order achieve this is to make money.

You must first get started before you can make money. Let's take a look at how we can get started.

How much debt is considered excessive?

It is essential to remember that money is not unlimited. If you spend more than you earn, you'll eventually run out of cash because it takes time for savings to grow. When you run out of money, reduce your spending.

But how much is too much? Although there's no exact number that will work for everyone, it is a good rule to aim to live within 10%. You won't run out of money even after years spent saving.

This means that, if you have $10,000 in a year, you shouldn’t spend more monthly than $1,000. If you make $20,000 per year, you shouldn't spend more then $2,000 each month. Spend no more than $5,000 a month if you have $50,000.

Paying off your debts quickly is the key. This includes credit card bills, student loans, car payments, etc. When these are paid off you'll have money left to save.

You should also consider whether you would like to invest any surplus income. If the stock market drops, your money could be lost if you put it towards bonds or stocks. If you save your money, interest will compound over time.

As an example, suppose you save $100 each week. That would amount to $500 over five years. In six years you'd have $1000 saved. In eight years, you'd have nearly $3,000 in the bank. When you turn ten, you will have almost $13,000 in savings.

You'll have almost $40,000 sitting in your savings account at the end of fifteen years. This is quite remarkable. You would earn interest if the same amount had been invested in the stock exchange during the same period. Instead of $40,000, you'd now have more than $57,000.

It is important to know how to manage your money effectively. A poor financial management system can lead to you spending more than you intended.

What is the best way for a side business to make money?

If you want money fast, you will need to do more than simply create a product/service to solve a problem.

It is also important to establish yourself as an authority in the niches you choose. It's important to have a strong online reputation.

Helping people solve problems is the best way build a reputation. Ask yourself how you can be of value to your community.

Once you answer that question you'll be able instantly to pinpoint the areas you're most suitable to address. There are many online ways to make money, but they are often very competitive.

However, if you look closely you'll see two major side hustles. One involves selling products directly to customers and the other is offering consulting services.

There are pros and cons to each approach. Selling products and services can provide instant gratification since once you ship the product or deliver the service, payment is received immediately.

But, on the other hand, you might not have the success you desire if you do not spend the time to build relationships with potential clientele. In addition, the competition for these kinds of gigs is fierce.

Consulting allows you to grow and manage your business without the need to ship products or provide services. However, it can take longer to be recognized as an expert in your area.

To be successful in either field, you must know how to identify the right customers. It will take some trial-and-error. But it will pay off big in the long term.

What is the difference between passive income and active income?

Passive income is when you make money without having to do any work. Active income is earned through hard work and effort.

Your active income comes from creating value for someone else. It is when someone buys a product or service you have created. Selling products online, writing ebooks, creating websites, and advertising your business are just a few examples.

Passive income is great because it allows you to focus on more important things while still making money. Most people don't want to work for themselves. So they choose to invest time and energy into earning passive income.

Passive income doesn't last forever, which is the problem. You might run out of money if you don't generate passive income in the right time.

Also, you could burn out if passive income is not generated in a timely manner. Start now. You will miss opportunities to maximize your earnings potential if you put off building passive income.

There are three types to passive income streams.

-

There are several options available for business owners: you can start a company, buy a franchise and become a freelancer. Or rent out your property.

-

Investments - these include stocks and bonds, mutual funds, and ETFs

-

Real Estate includes flipping houses, purchasing land and renting properties.

Which side hustles have the highest potential to be profitable?

Side hustle is a term used to describe any side income streams that can supplement your main source.

Side hustles provide extra income for fun activities and bills.

In addition, side hustles also help you save more money for retirement, give you time flexibility, and may even increase your earning potential.

There are two types. Side hustles that are passive include side businesses such as blogging, e-commerce and freelancing. Some of the active side hustles are tutoring, dog walking and selling eBay items.

Side hustles that make sense and work well with your lifestyle are the best. A fitness business is a great option if you enjoy working out. If you love to spend time outdoors, consider becoming an independent landscaper.

You can find side hustles anywhere. Consider side hustles where you spend your time already, such as volunteering or teaching classes.

If you are an expert in graphic design, why don't you open your own graphic design business? Perhaps you're an experienced writer so why not go ghostwriting?

Be sure to research thoroughly before you start any side hustle. So when an opportunity presents itself, you will be prepared to take it.

Remember, side hustles aren't just about making money. Side hustles can be about creating wealth or freedom.

There are so many ways to make money these days, it's hard to not start one.

Statistics

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

External Links

How To

How To Make Money Online

It is much easier to make money online than it was 10 years ago. How you invest your funds is changing as well. While there are many methods to generate passive income, most require significant upfront investment. Some methods are easier than others. You should be aware of these things if you are serious about making money online.

-

Find out what kind of investor you are. PTC sites are a great way to quickly make money. You get paid to click ads. On the other hand, if you're more interested in long-term earning potential, then you might prefer to look at affiliate marketing opportunities.

-

Do your research. Before you make a commitment to any program, do your research. Read through reviews, testimonials, and past performance records. You don't want your time or energy wasted only to discover that the product doesn’t work.

-

Start small. Do not just jump in to one huge project. Start small and build something first. This will help to you get started and allow you to decide if this type business is right for your needs. You can expand your efforts to larger projects once you feel confident.

-

Get started now! It's never too early to begin making money online. Even if you've been working full-time for years, you still have plenty of time left to build a solid portfolio of profitable niche websites. You just need a good idea, and some determination. Take action now!