It is crucial to know your rights when you are sued in relation to credit card debt. You may be harassed by the debt collection agency using strong-arm tactics. It might also mislead customers about how much they owe. A lawyer will be necessary to protect your rights in such cases. You have certain rights as set out in your credit card agreement.

If you are sued by a credit card company for debts

Your credit card company may have filed a lawsuit if you are unable to pay your bills on time. Although this can be frustrating, it doesn't mean that you are doomed. Many cases can be settled without ever going to court. A lawyer can also be helpful.

Credit card debt collection agencies can be threatening and aggressive. They may not even tell you the actual amount of money you owe. You may even need to hire a lawyer to help you negotiate with the debt collection agency. You have the legal right to settle your outstanding debt. Make sure you read all terms and conditions of your credit card agreement.

Common defenses that can be raised in a lawsuit

You can usually use the following defenses to defend yourself in a lawsuit to pay off your credit card debt. In this scenario, the creditor company may have sold your information to another agency with no legal basis to sue. This defense can prove valuable if credit card companies were wrong about the identity and motives of the accused.

Another defense you may use to support your claim in a lawsuit against a credit card company to settle your credit cards debt is that they did not file the suit in time. This defense is known simply as the "statute of limitations," and it could lead to your case being dismissed. It is important to speak with an attorney before you file a lawsuit.

Which case should you be represented in?

Unpaid debts and lawsuits from credit card companies can make it difficult to cope. However, you do have some options. If you choose to represent yourself, you can present your side of the story and present arguments in court. This can have an impact on the outcome of the case.

A debt collection agency may use strong-arm techniques to collect debt. Additionally, their assessment may not be accurate. If you decide to represent yourself, it is important to know your rights as a credit card user. These rights are detailed in your credit card agreement. These rights should always be known and protected.

Negotiating a settlement deal with a credit union

There are many factors that could influence the willingness of a creditcard company to settle with you. The first factor is the amount of your balance. The credit card company may not be willing to negotiate if you are behind on your payments. It wants to see proof that you can afford the settlement amount. The second is your current interest rate.

First, contact your credit card company. Reach out to their customer support department and ask for a representative from the debt settlements division. Be honest about your situation. Stress that you are in a difficult situation and do not have the money to pay your monthly bills. Mention that you have multiple accounts. You will get a better offer if you mention multiple accounts.

Before you sign up for a debt settlement program, do your research.

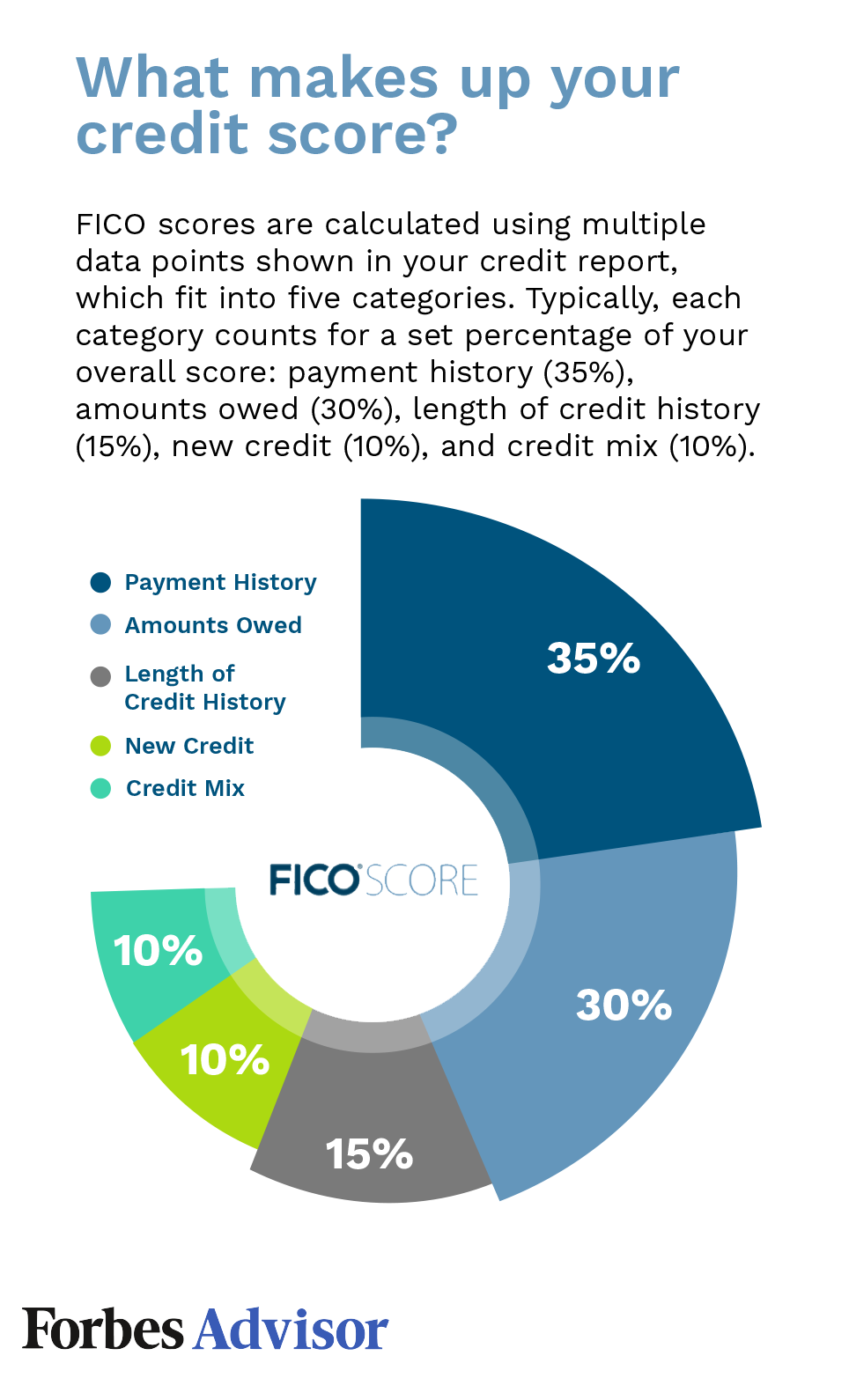

Debt settlement programs come with many risks. Before you sign up, you need to do your research. Your credit score is one of the greatest risks. If your accounts are in bad standing, the impact will be smaller. Larger balances can have a greater impact on your credit score than smaller ones. You should ensure you are able to afford the debt settlement payments before enrolling in one.

One of the dangers of debt settlement is that you could end up deeper in debt than ever before. Some companies may ask you to stop paying your creditors. This will adversely affect your credit score. You could also face penalties and late fees. Additionally, you could face a lawsuit if you fail to make payments. Your creditors may also file a lawsuit to garnish your wages or place a lien against your house.

FAQ

What are the most profitable side hustles in 2022?

The best way today to make money is to create value in the lives of others. If you do it well, the money will follow.

It may seem strange, but your creations of value have been going on since the day you were born. You sucked your mommy’s breast milk as a baby and she gave life to you. Learning to walk gave you a better life.

If you keep giving value to others, you will continue making more. You'll actually get more if you give more.

Everyone uses value creation every day, even though they don't know it. You're creating value all day long, whether you're making dinner for your family or taking your children to school.

In actuality, Earth is home to nearly 7 billion people right now. Each person is creating an amazing amount of value every day. Even if you created $1 worth of value an hour, that's $7 million a year.

It means that if there were ten ways to add $100 to the lives of someone every week, you'd make $700,000.000 extra per year. You would earn far more than you are currently earning working full-time.

Let's imagine you wanted to make that number double. Let's suppose you find 20 ways to increase $200 each month in someone's life. Not only would you make an additional $14.4million dollars per year, but you'd also become extremely wealthy.

Every day offers millions of opportunities to add value. This includes selling ideas, products, or information.

Even though we focus a lot on careers, income streams, and jobs, these are only tools that can help us achieve our goals. Ultimately, the real goal is to help others achieve theirs.

Create value to make it easier for yourself and others. Start by downloading my free guide, How to Create Value and Get Paid for It.

Why is personal finance important?

If you want to be successful, personal financial management is a must-have skill. We live in a world that is fraught with money and often face difficult decisions regarding how we spend our hard-earned money.

Why do we delay saving money? Is it not better to use our time or energy on something else?

Yes, and no. Yes, as most people feel guilty about saving their money. You can't, as the more money that you earn, you have more investment opportunities.

If you can keep your eyes on what is bigger, you will always be able spend your money wisely.

Controlling your emotions is key to financial success. You won't be able to see the positive aspects of your situation and will have no support from others.

Your expectations regarding how much money you'll eventually accumulate may be unrealistic. This could be because you don't know how your finances should be managed.

After mastering these skills, it's time to learn how to budget.

Budgeting is the act or practice of setting aside money each month to pay for future expenses. By planning, you can avoid making unnecessary purchases and ensure that you have sufficient funds to cover your bills.

You now have the knowledge to efficiently allocate your resources and can start to see a brighter financial future.

Which passive income is easiest?

There are many online ways to make money. But most of them require more time and effort than you might have. How can you make extra cash easily?

Finding something you love is the key to success, be it writing, selling, marketing or designing. That passion can be monetized.

For example, let's say you enjoy creating blog posts. Start a blog where you share helpful information on topics related to your niche. When readers click on the links in those articles, they can sign up for your emails or follow you via social media.

This is affiliate marketing. There are lots of resources that will help you get started. Here's a collection of 101 affiliate marketing tips & resources.

As another source of passive income, you might also consider starting your own blog. You'll need to choose a topic that you are passionate about teaching. You can also make your site monetizable by creating ebooks, courses and videos.

While there are many options for making money online, the most effective ones are the easiest. If you really want to make money online, focus on building websites or blogs that provide useful information.

Once you've created your website promote it through social media like Facebook, Twitter LinkedIn, Pinterest Instagram, YouTube, and many other sites. This is called content marketing, and it's a great method to drive traffic to your website.

How much debt is considered excessive?

It's essential to keep in mind that there is such a thing as too much money. You will eventually run out money if you spend more than your income. Because savings take time to grow, it is best to limit your spending. So when you find yourself running low on funds, make sure you cut back on spending.

But how much can you afford? There's no right or wrong number, but it is recommended that you live within 10% of your income. This will ensure that you don't go bankrupt even after years of saving.

This means that even if you make $10,000 per year, you should not spend more then $1,000 each month. Spend less than $2,000 per monthly if you earn $20,000 a year. Spend no more than $5,000 a month if you have $50,000.

It is important to get rid of debts as soon as possible. This includes student loans, credit card debts, car payments, and credit card bill. Once these are paid off, you'll still have some money left to save.

It's best to think about whether you are going to invest any of the surplus income. If you decide to put your money toward stocks or bonds, you could lose money if the stock market falls. If you save your money, interest will compound over time.

Consider, for example: $100 per week is a savings goal. Over five years, that would add up to $500. After six years, you would have $1,000 saved. In eight years you would have almost $3,000 saved in the bank. In ten years you would have $13,000 in savings.

Your savings account will be nearly $40,000 by the end 15 years. This is quite remarkable. You would earn interest if the same amount had been invested in the stock exchange during the same period. Instead of $40,000, you'd now have more than $57,000.

That's why it's important to learn how to manage your finances wisely. If you don't do this, you may end up spending far more than you originally planned.

How do rich people make passive income?

There are two ways you can make money online. One is to create great products/services that people love. This is known as "earning" money.

Another way is to create value for others and not spend time creating products. This is "passive" income.

Let's suppose you have an app company. Your job is development apps. Instead of selling apps directly to users you decide to give them away free. That's a great business model because now you don't depend on paying users. Instead, advertising revenue is your only source of income.

To help you pay your bills while you build your business, you may also be able to charge customers monthly.

This is the way that most internet entrepreneurs are able to make a living. They give value to others rather than making stuff.

How to build a passive income stream?

To generate consistent earnings from one source, you have to understand why people buy what they buy.

This means that you must understand their wants and needs. This requires you to be able connect with people and make sales to them.

Next, you need to know how to convert leads to sales. To retain happy customers, you need to be able to provide excellent customer service.

Even though it may seem counterintuitive, every product or service has its buyer. You can even design your entire business around that buyer if you know what they are.

A lot of work is required to become a millionaire. A billionaire requires even more work. Why? Why?

You can then become a millionaire. Finally, you must become a billionaire. The same applies to becoming a millionaire.

So how does someone become a billionaire? You must first be a millionaire. You only need to begin making money in order to reach this goal.

You have to get going before you can start earning money. Let's now talk about how you can get started.

Statistics

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

External Links

How To

How to make money online

It is much easier to make money online than it was 10 years ago. The way you invest your money is also changing. There are many ways you can earn passive income. However, some require substantial upfront investment. Some methods are easier than other. However, there are many things you need to do before investing your hard-earned funds in anything online.

-

Find out what kind of investor you are. PTC sites are a great way to quickly make money. You get paid to click ads. However, if long-term earning potential is more important to you, you might consider affiliate marketing opportunities.

-

Do your research. You must research any program before you decide to commit. Review, testimonials and past performance records are all good places to start. It is not worth wasting your time and effort only to find out that the product does not work.

-

Start small. Do not just jump in to one huge project. Instead, build something small first. This will let you gain experience and help you determine if this type of business suits you. When you feel confident, expand your efforts and take on bigger projects.

-

Get started now! It's never too late to start making money online. Even if you've been working full-time for years, you still have plenty of time left to build a solid portfolio of profitable niche websites. All that's required is a good idea as well as some commitment. Now is the time to get started!